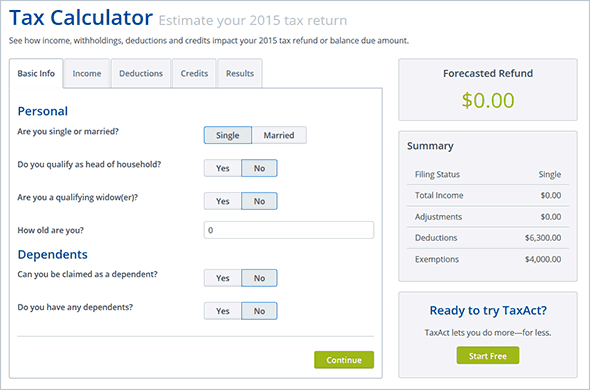

Tax act refund calculator

Athletes or sportsmens fees or. Rules Income Tax Rules.

Income Tax Refund In 2022

Use our simple tax refund calculator to see if you are eligible for a refund Fill in the application form All we need is your work history and some personal details Sign and post the claim form we email to you This allows us to act on your behalf with HMRC -.

. Budget and Bills Finance Acts. 110 of 2010 Direct Taxes Code 2013. A taxpayer can claim income tax refund as per Section 237 of Income Tax Act 1961.

But with the advent of e-transfer of refunds Form 30 is no longer required. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

If you remit interest and additions to tax to the State Tax Department based on use of this Tax Calculator and it is later determined that additional interest and additions to tax are due the Department will issue to you a notice for the additional amount due. Income from other countries. Similarly the calculator cannot be utilized in cases where income spreading is involved for.

See the Minnesota Property Tax Refund Instructions for additional information. Budget and Bills Finance Acts. West Virginia Personal Income Tax Act.

Rules Income Tax Rules. Your tax situation is complex. Estimate your tax withholding with the new Form W-4P.

This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

Fastest refund possible. However do keep in. Find prior year tax rate schedules using the Forms and.

CAs experts and businesses can get GST ready with Clear GST software certification course. Jan 13 2022 - 115333 AM. LLC S-Corp C-Corp - you name it well calculate it Services.

If you claimed either of those tax breaks a PATH Act message may appear when you use the Wheres My Refund. To check the status of your property tax refund online. You have nonresident alien status.

This includes alternative minimum tax long-term capital gains or qualified dividends. The IRS issues more than 9 out of 10 refunds in less than 21 days. Our GST Software helps CAs.

Payments are expected to be issued between October 2022 and January 2023. If you prefer you can call the automated refund tracking line at 651-296-4444 Metro or 1-800-657-3676 Greater Minnesota. Nonresidents withholding tax.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. If you have paid higher tax to the government in the previous financial year FY ie FY 2019-20 then you are required to file your income tax return ITR to claim the refund amount. Stock options on the basis of employment.

Higher tax is usually paid when during the financial year the advance tax paid by an individual self-assessment andor tax deducted at source TDS is more than their tax liability. The calculator does not give a good estimate if you receive. See Publication 505 Tax Withholding and Estimated Tax.

The Middle Class Tax Refund is a one-time payment to provide relief to Californians. Tax refund time frames will vary. Other Direct Tax Rules.

Earlier Form 30 was required to claim income tax refund. Under the Protecting Americans from Tax Hikes PATH Act of 2015 the IRS is required to hold tax returns for folks who claimed those credits until Feb. Check our 2022 tax refund schedule for more information or use the IRS2Go app to learn your status.

Get your tax refund up to 5 days early. Direct Taxes Code 2010 Bill No. You should count another week into your time estimate if you request your refund as a check rather than a direct deposit.

Alternative Minimum Tax AMT 2019. If you are eligible you will automatically receive a payment. Generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

Fastest tax refund with e-file and direct deposit. Direct Taxes Code 2010 Bill No. 110 of 2010 Direct Taxes Code 2013.

West Virginia Income. Find prior year tax tables using the Forms and Publications Search. After your income tax return ITR is processed you might get an intimation notice from the income tax department.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of. Alternative Minimum Tax AMT Prior years. For 2020 tax returns filed in 2021 the IRS said it planned to issue more than 90 of refunds within 21 days of e-filing.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. In case there is an income tax refund due to you as per the income tax departments calculations it typically gets credited to your bank account in few weeks.

Summary of Penalties Under the Income Tax Act Updated on. The intimation notice informs if you have an income tax refund due or not. In keyword field type tax table Tax rate schedules 2021.

Option to pay with your tax refund for an extra fee. It is not your tax refund. Other Direct Tax Rules.

Taxfyles small business tax calculator accurately estimates your business tax refundliability at the end of the year. Loans are offered in amounts of 250 500 750 1250 or 3500. This is an optional tax refund-related loan from MetaBank NA.

The handling of losses.

Here S The No 1 Thing Americans Do With Their Tax Refund Gobankingrates

4 Tips For Organizing Your Tax Information Taxact Blog Business Tax Deductions Small Business Tax Deductions Small Business Deductions

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Calculator Estimate Your Taxes And Refund For Free

See Your Refund Before Filing With A Tax Refund Estimator

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

Can Being Married Get You A Higher Tax Refund Tax Refund Legal Services Private Limited Company

You Are Losing These Benefits If You Didn T File Itr Till Now Income Tax Return Tax Return Benefit

The Average Tax Refund In Every State Smartasset

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

5 Quick Tips For Doing Your Own Taxes Meet Penny Diy Taxes Budgeting Money Money Saving Plan

Best Tax Apps For Iphone And Ipad In 2022 Igeeksblog Tax App Tax Prep Mileage Tracker

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Fy 2021 22 Or Ay 2022 23 New Income Tax Return E Filing Exemptions Deductions E Payment Refund Only 30 Second

Tax Refund Check Hi Res Stock Photography And Images Alamy